xe/dash offers a data-driven approach to analyzing stocks, using a combination of fundamental data and quantitative analysis to provide users with a comprehensive understanding of key information.

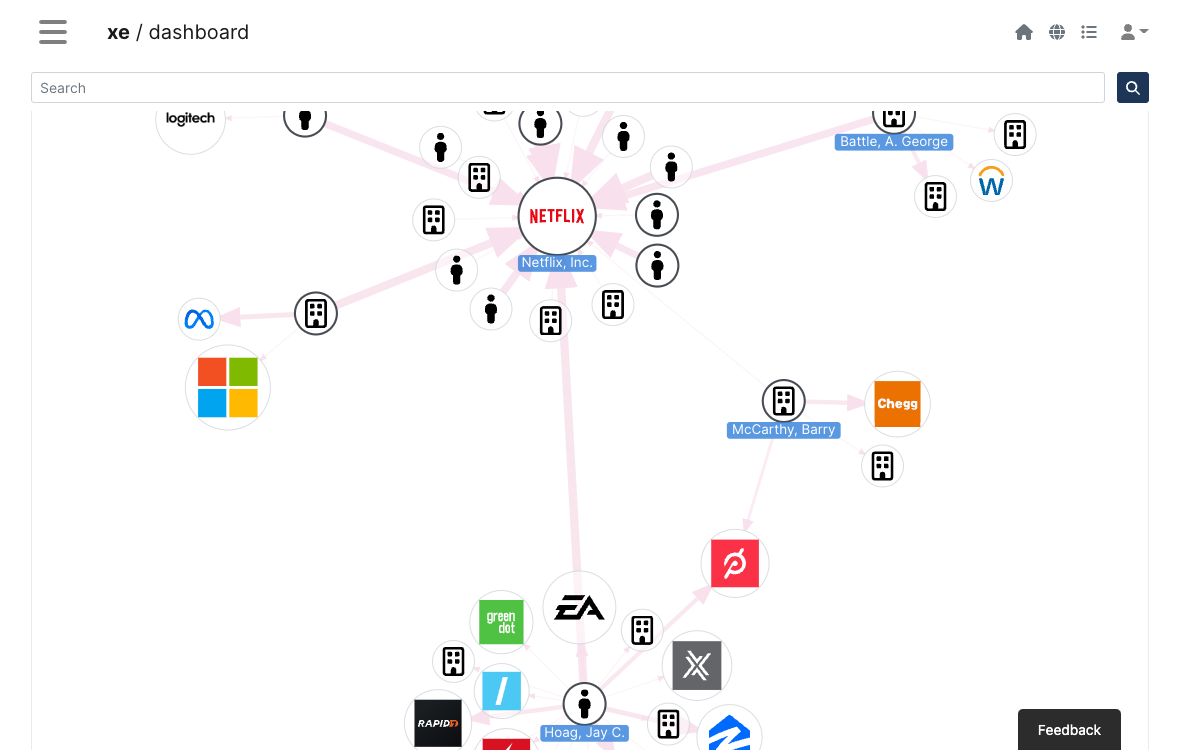

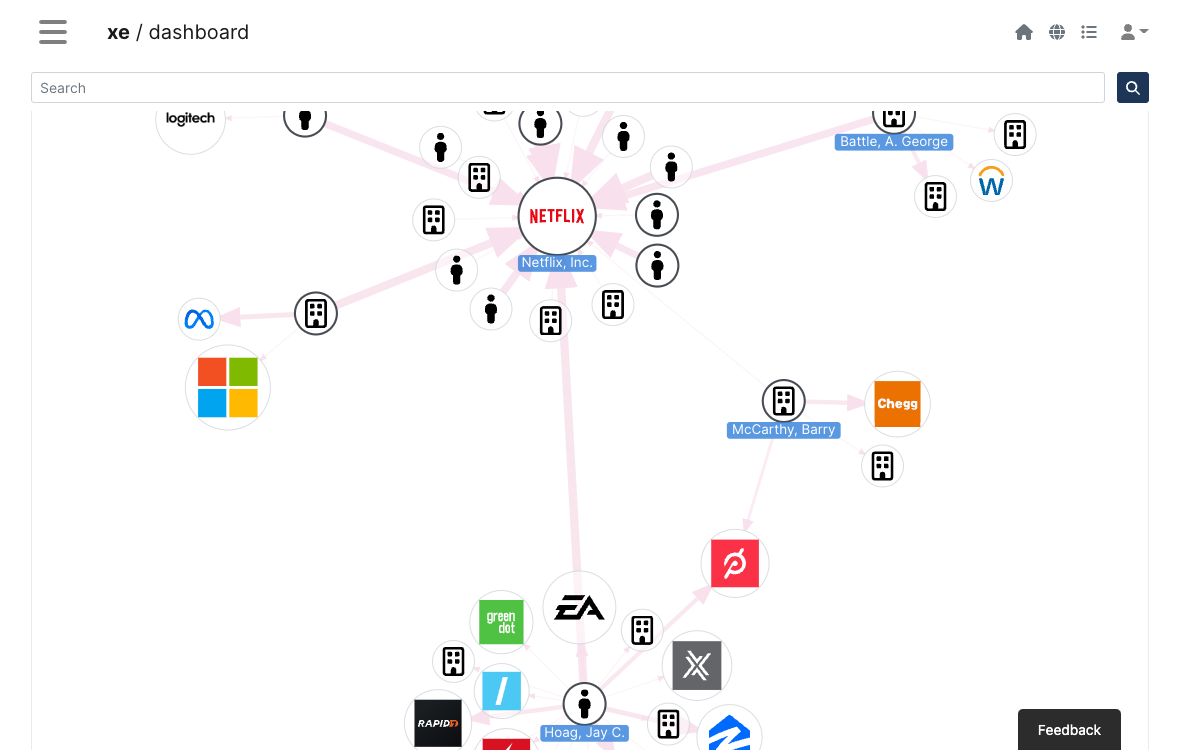

Knowledge Graph

Uncover previously undiscovered connections with our interactive tool for tracing complex relationships. Explore and discover new insights!

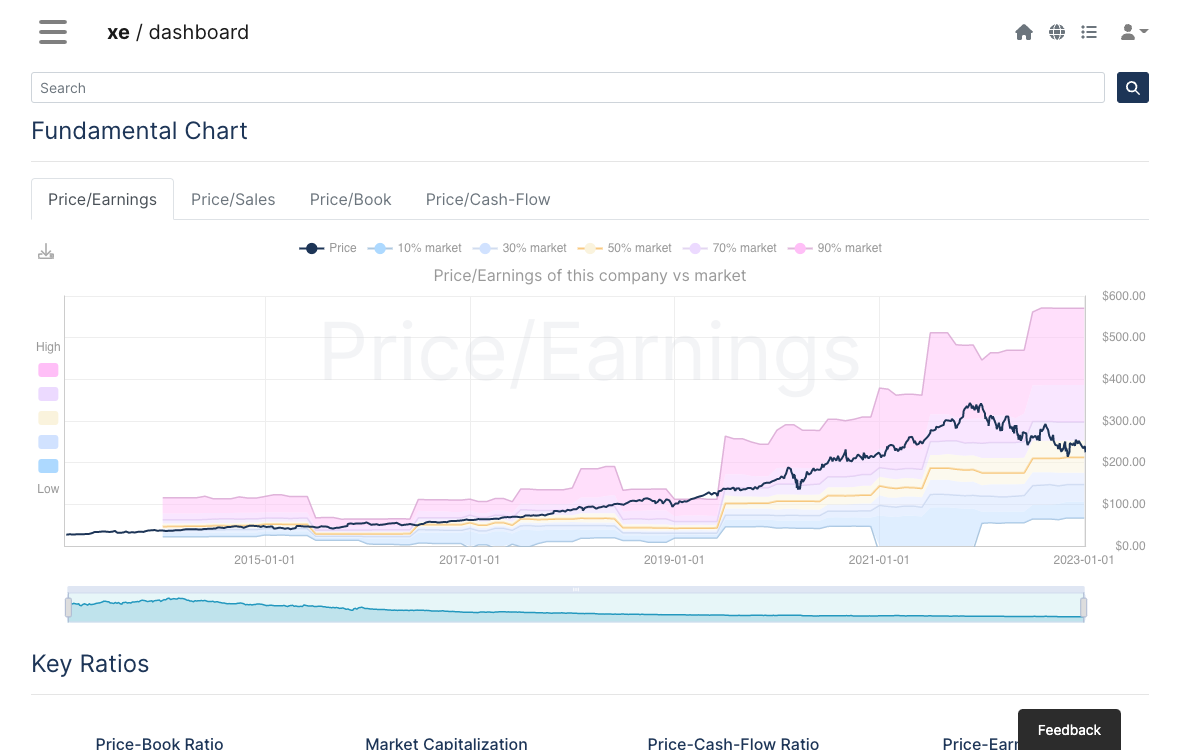

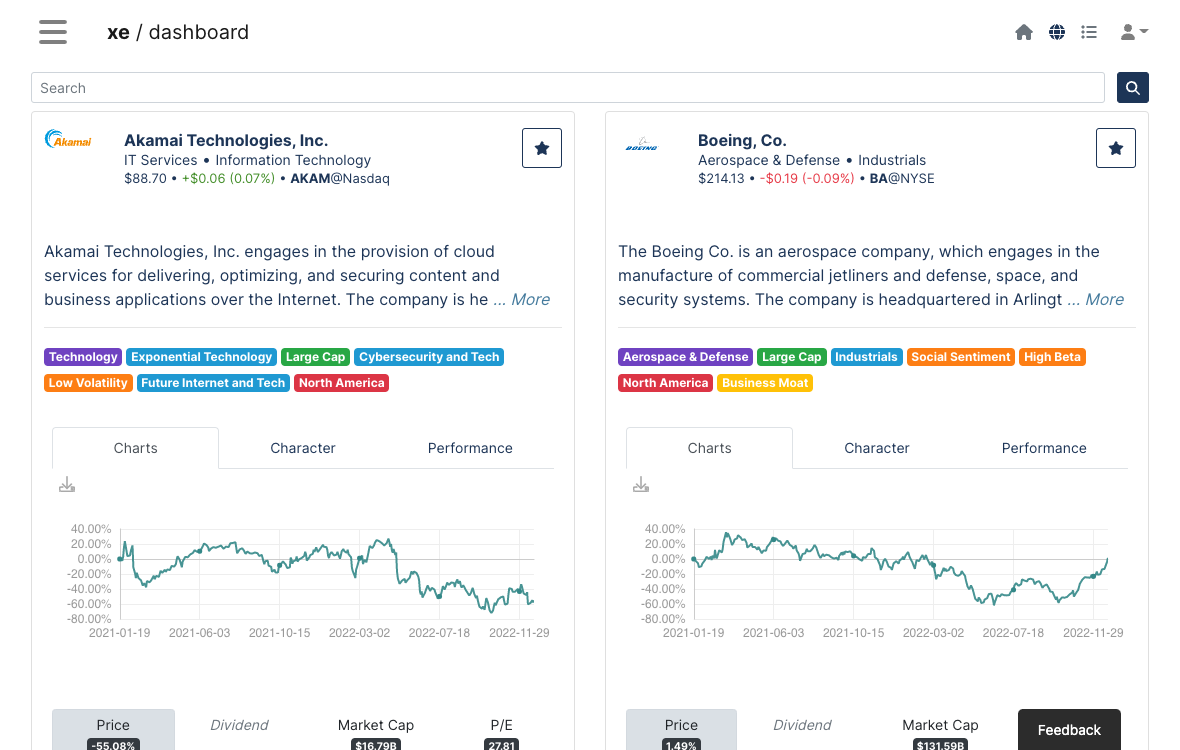

Fundamental Charts

Evaluate key company metrics and compare them to past performance and the overall market to determine the validity of the company's valuation. Utilize our analysis tool to make informed decisions.

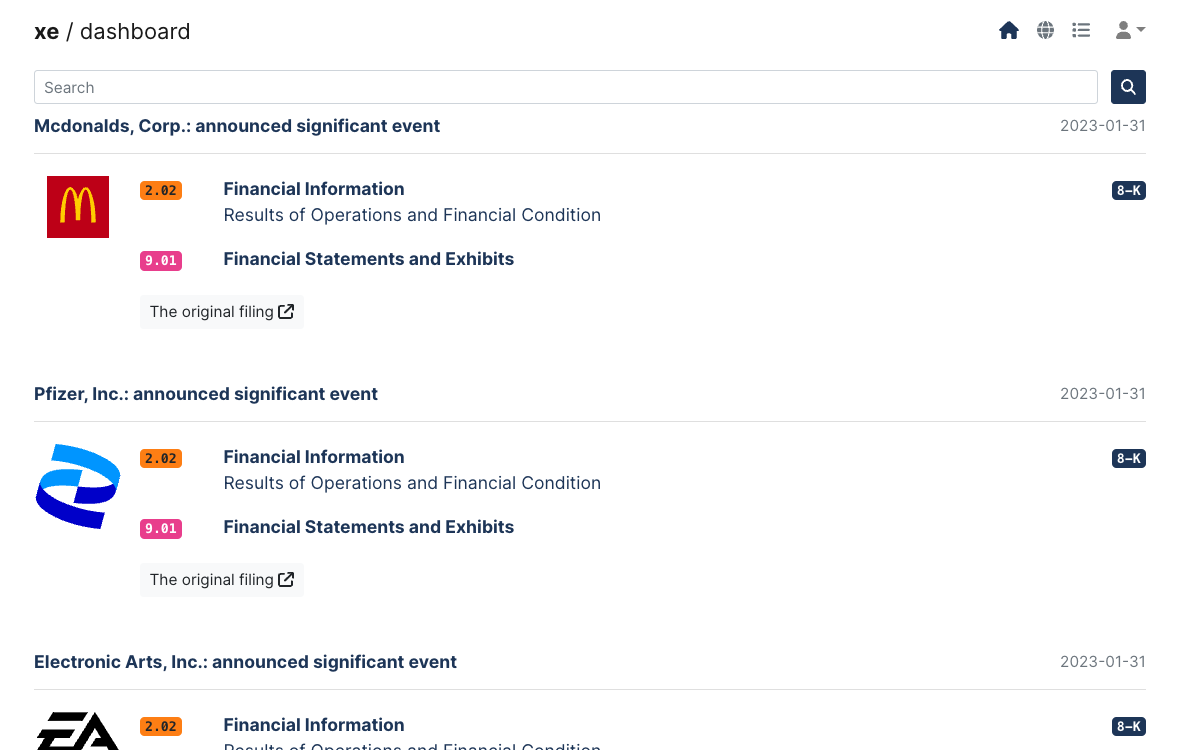

Personalized Feed

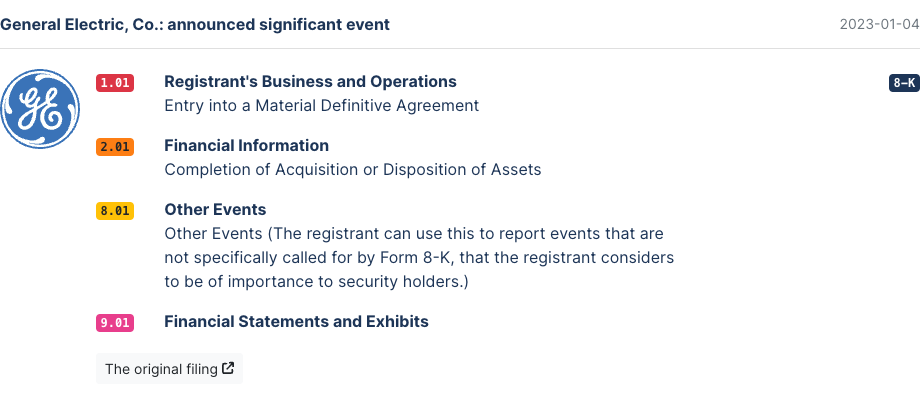

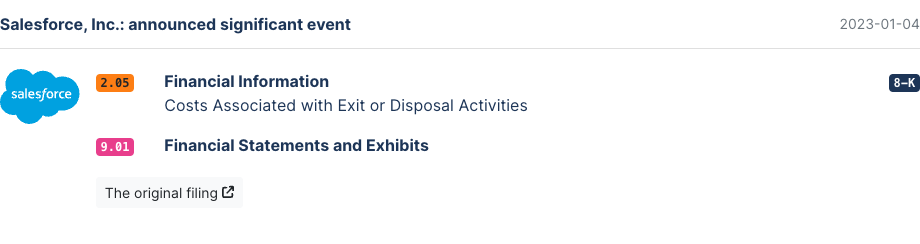

Stay informed and up-to-date with personalized, relevant information. Keep track of important events with our summary of the most crucial updates.

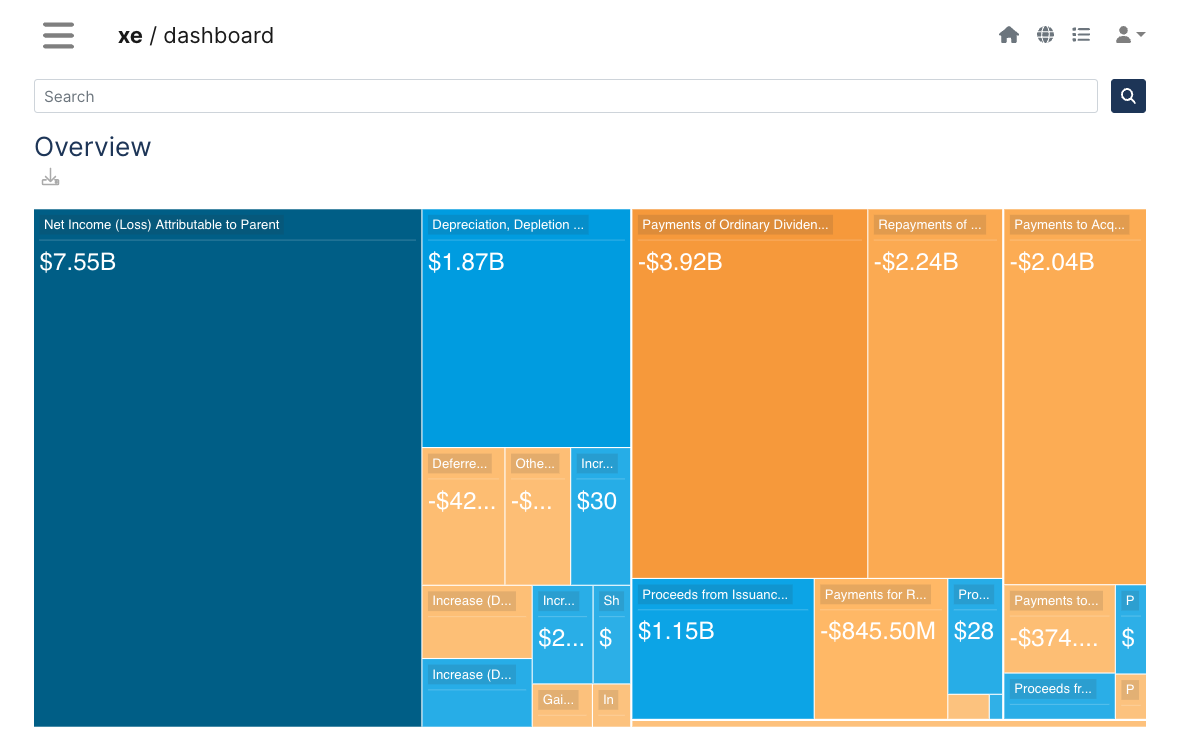

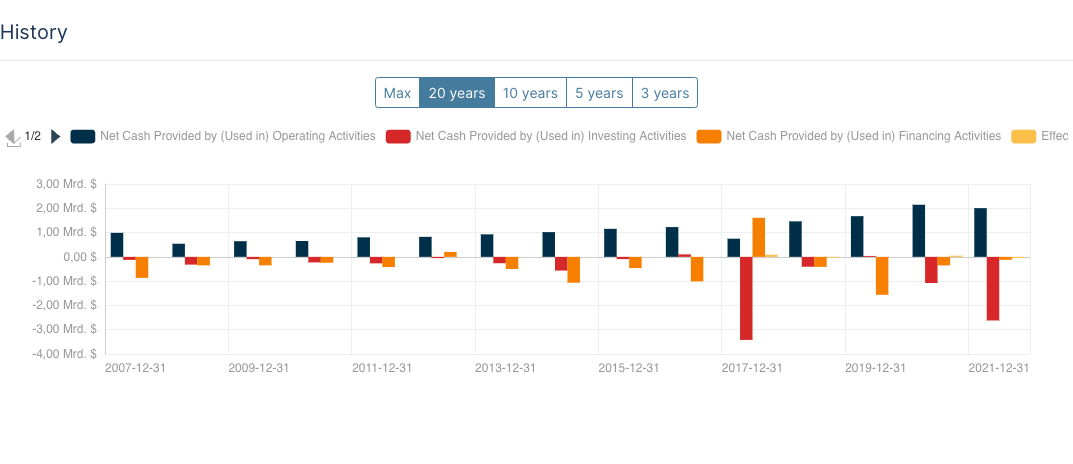

Corporate Reports

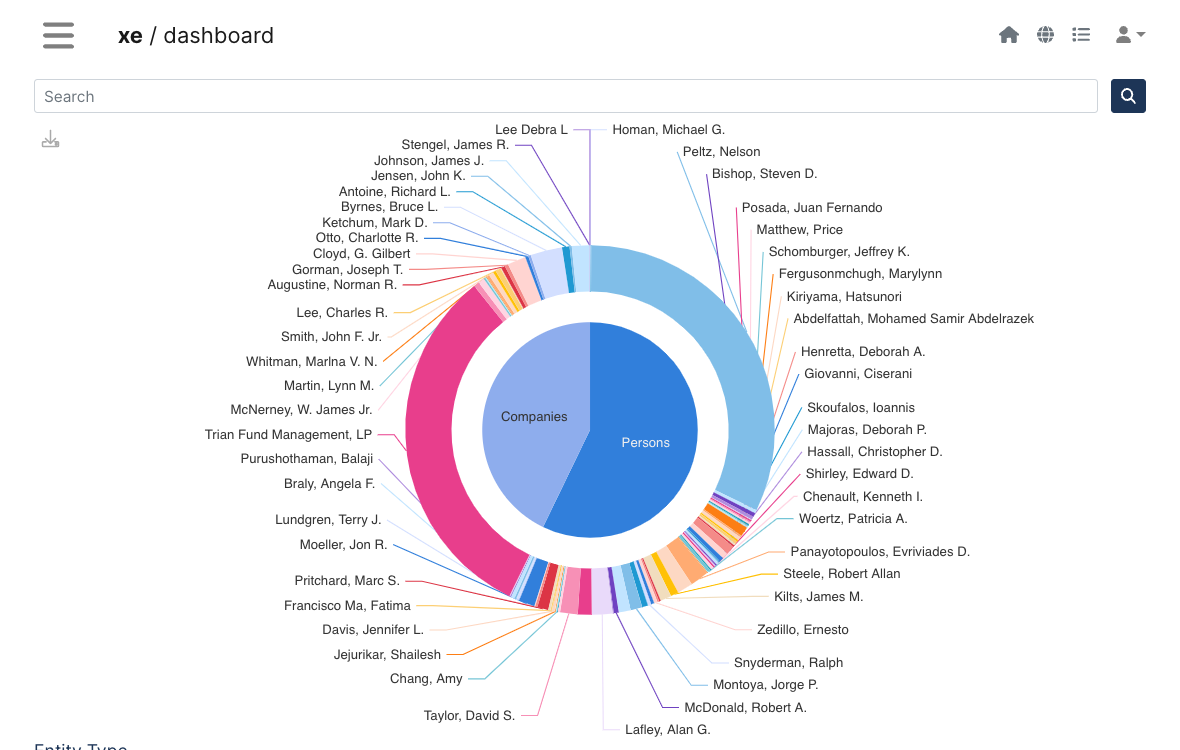

Gain valuable insights from visual representations of corporate reports. Customize your own charts to focus on the key figures that matter to you.

Experience Next-Level Investment Insights now!

Fundamental Analysis

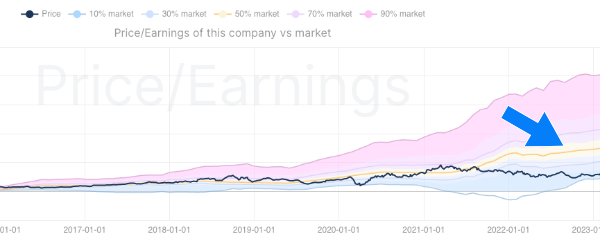

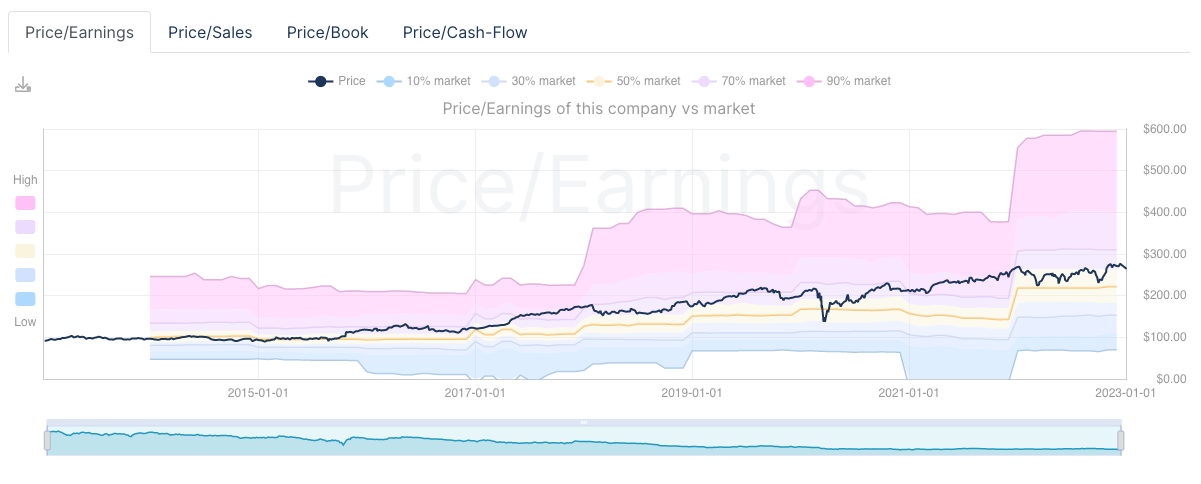

Fundamental Charts

Evaluate the share price based on key company metrics such as revenue, earnings, expenses, assets, and liabilities. Compare this data to the typical ratings of the market using fundamental charts, which display a company's financial and operational data over a specific period of time.

This information can help you determine if the stock price is justified by the company's performance and financial health. Fundamental charts can also be useful for company management as a way to track and analyze financial performance over time.

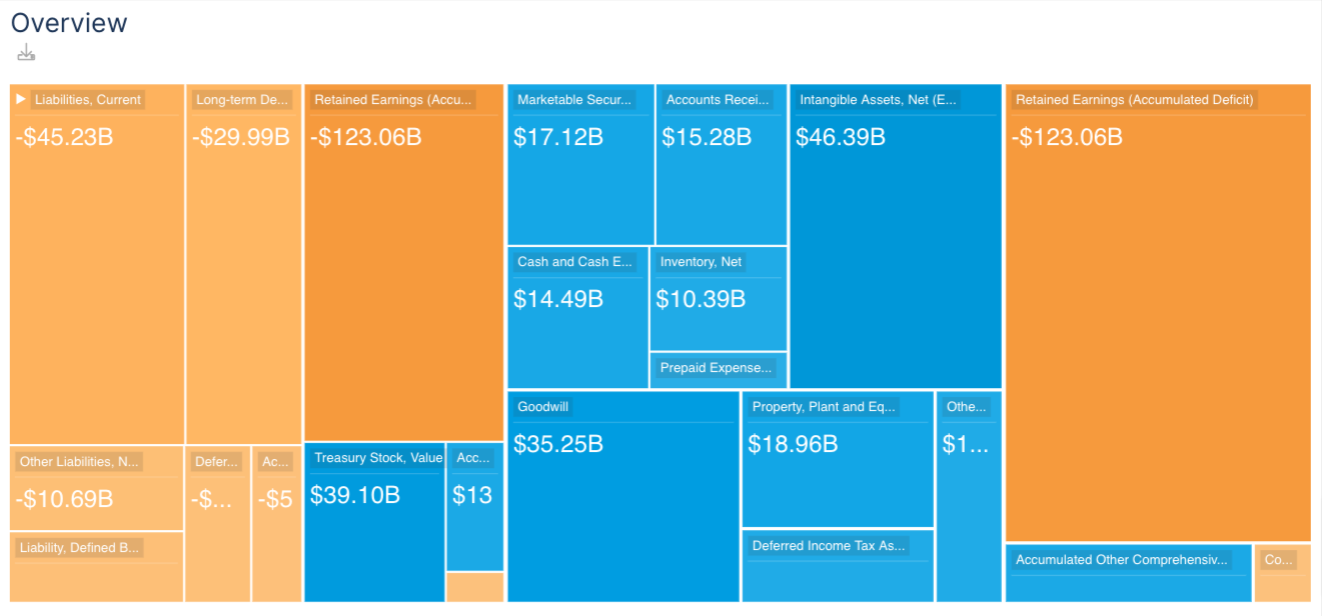

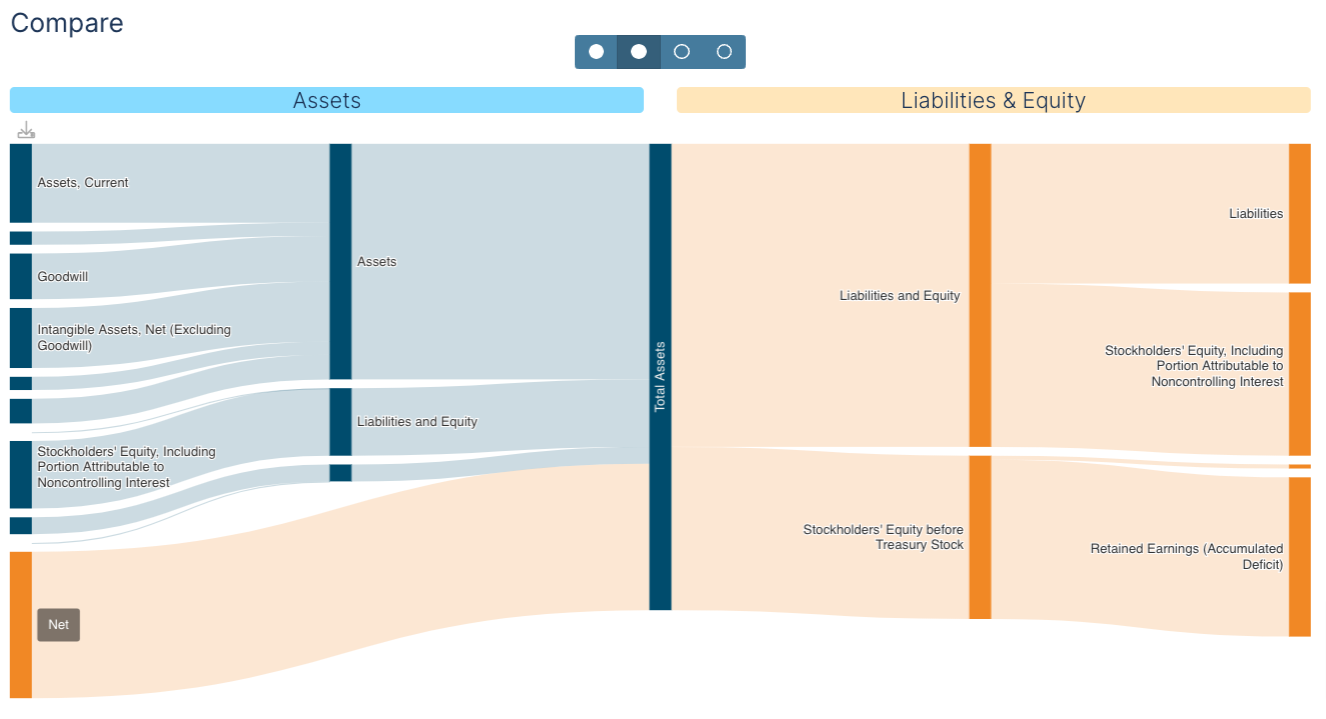

Business Figures

Quickly access relevant information with our direct processing of SEC data. Use Sankey charts to see which items make up the debit and credit side, and explore how accounting items are hierarchically composed with our tree map feature. Follow the company's progress over multiple years to stay informed and make informed decisions.

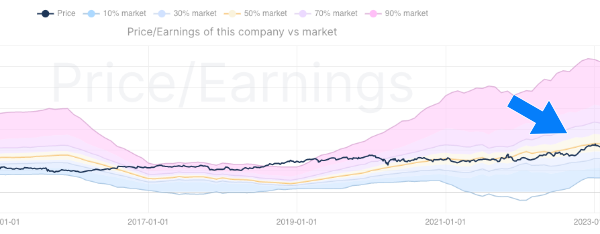

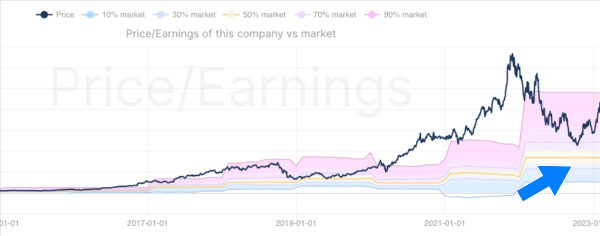

Ratios with market comparison

Compare companies using key figures with our ratio analysis tool. Go beyond simple comparisons and see how a company stacks up against its peers by analyzing the distribution of higher and lower scores. Determine if a company is above or below average with this valuable insight.

Network & Connections

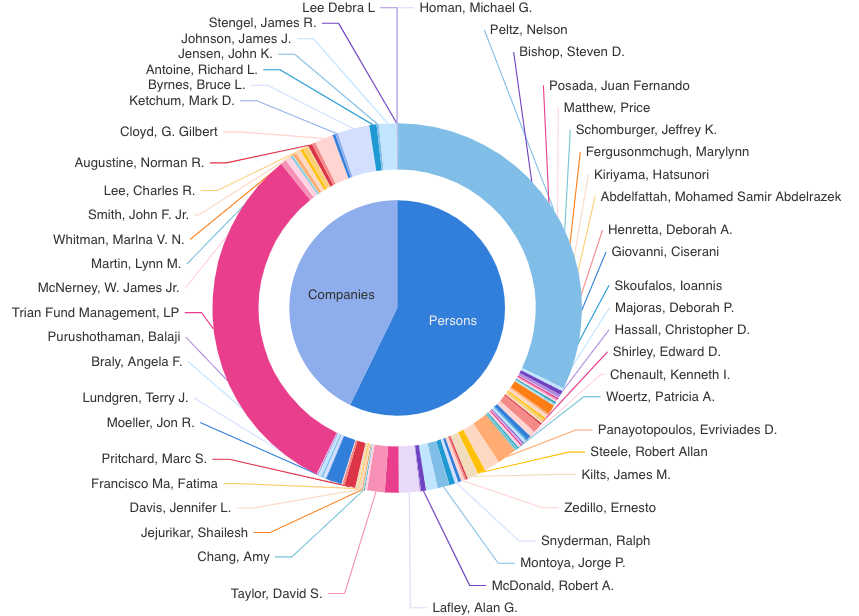

Knowledge Graph

Understanding complex relationships can be a daunting task, but with our interactive tool, you can easily explore and unravel these connections. Our tool allows you to trace relationships and uncover previously undiscovered connections, providing valuable insights and helping you make informed decisions.

Our network connects data points on multiple levels, providing you with information on holdings, ownership, decision-makers, and correlations.

Complex relationships can be explored interactively in this way.

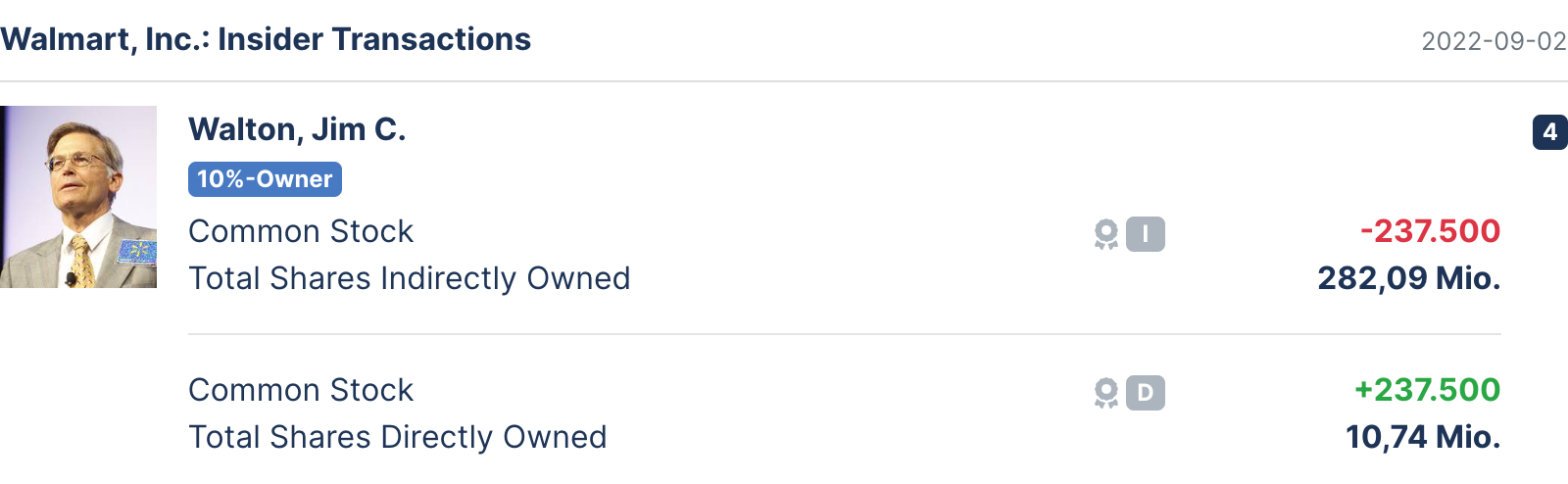

Holdings, Ownership & Insiders

Uncover ownership and track insider transactions of your companies to increase transparency and gain valuable insights.

Insider stock purchases, particularly share and stock options, can indicate the expectations and sentiment of decision-makers towards the company's future performance.

Insider transactions can also be used to identify potential conflicts of interest.

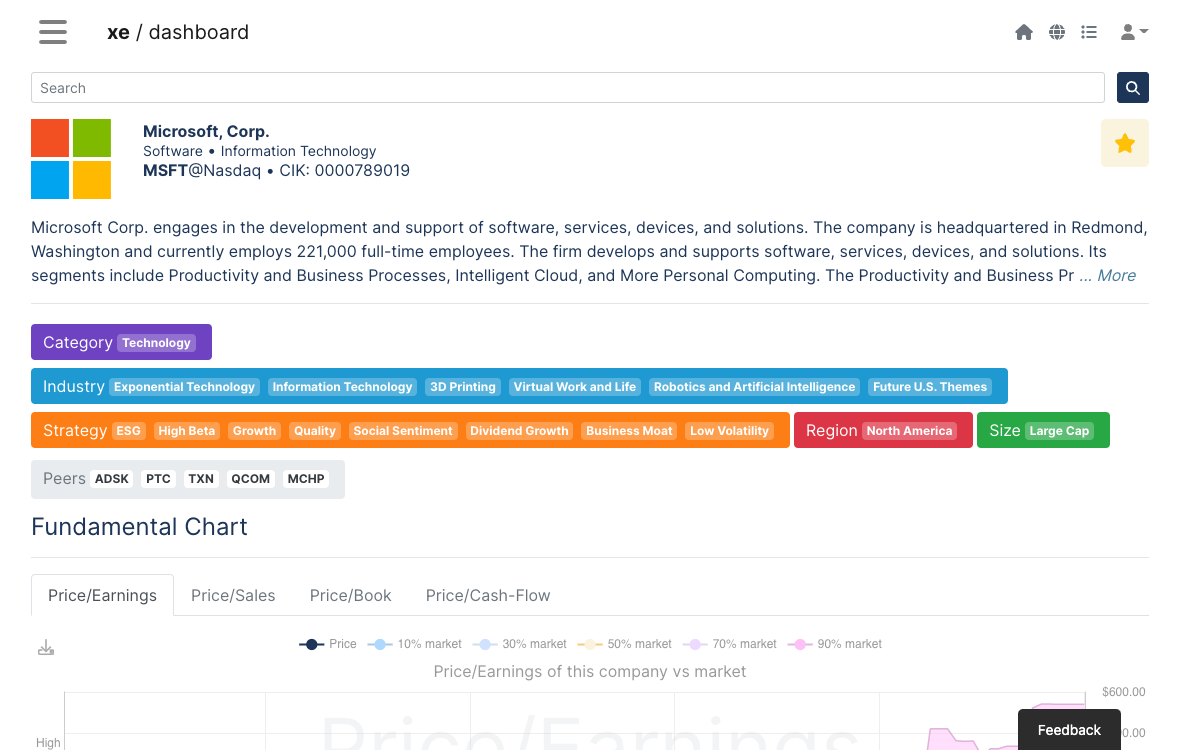

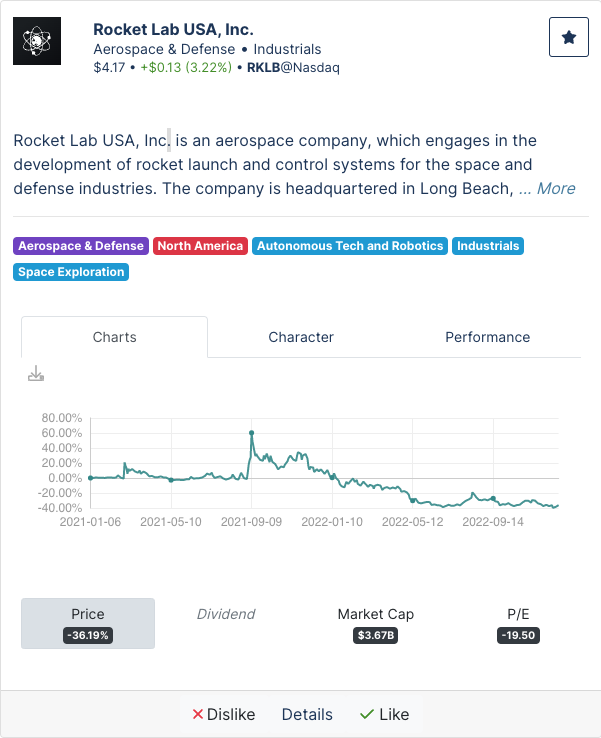

Smart Classification

The system follows professional fund managers and autonomously classifies a wide range of companies according to characteristics such as investment strategy, moated business model, momentum, innovation, dividend aristocrats, volatility and quality.

By tracking professional fund managers and categorizing companies based on characteristics such as investment strategy and innovation, you can get a sense of how these experts and industry leaders view the company and its potential. In addition, tracking and analyzing these metrics over time can help you identify trends and patterns that may not be immediately apparent, providing valuable insights into a company's performance and potential.

Personalized Feed

Reports, events and dates

All corporate reports are filtered by your companies, so you don't miss any business reports, profit warnings or insider transactions. In addition, we point out important macroeconomic dates that move the market.

Related Companies

Using the knowledge graph, we search for reports and events that are not directly included in your watch list but appear relevant through correlation or common holdings.

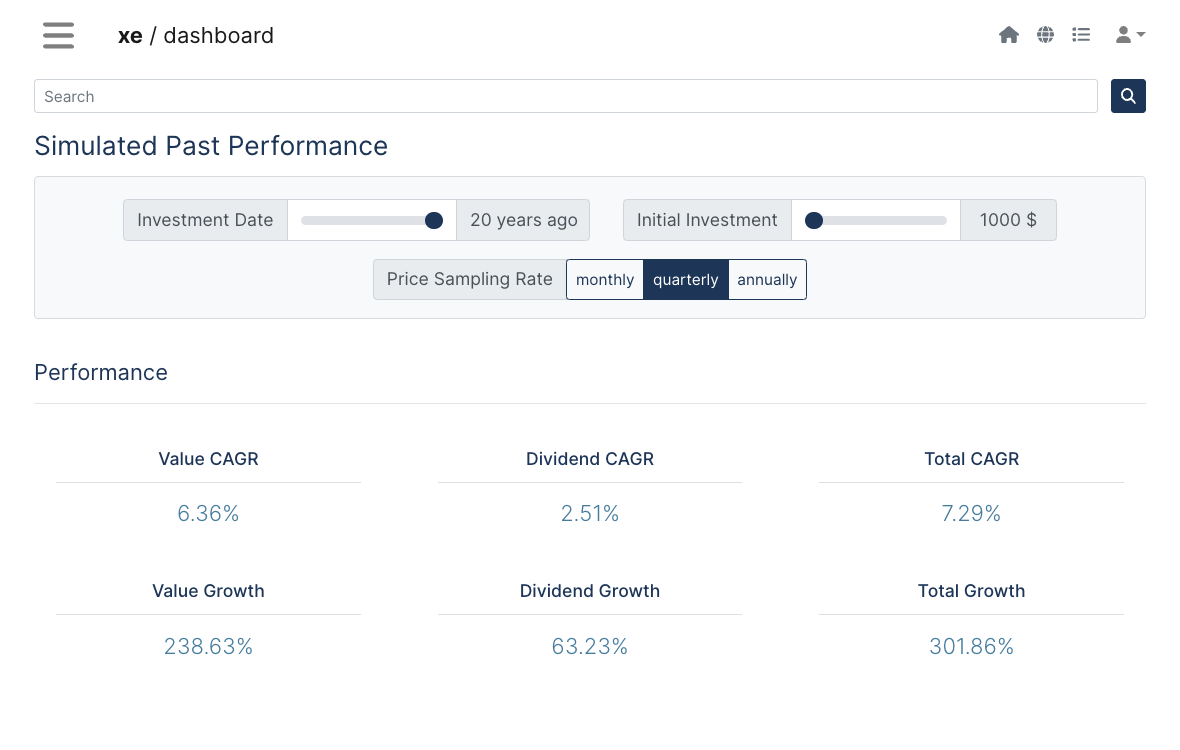

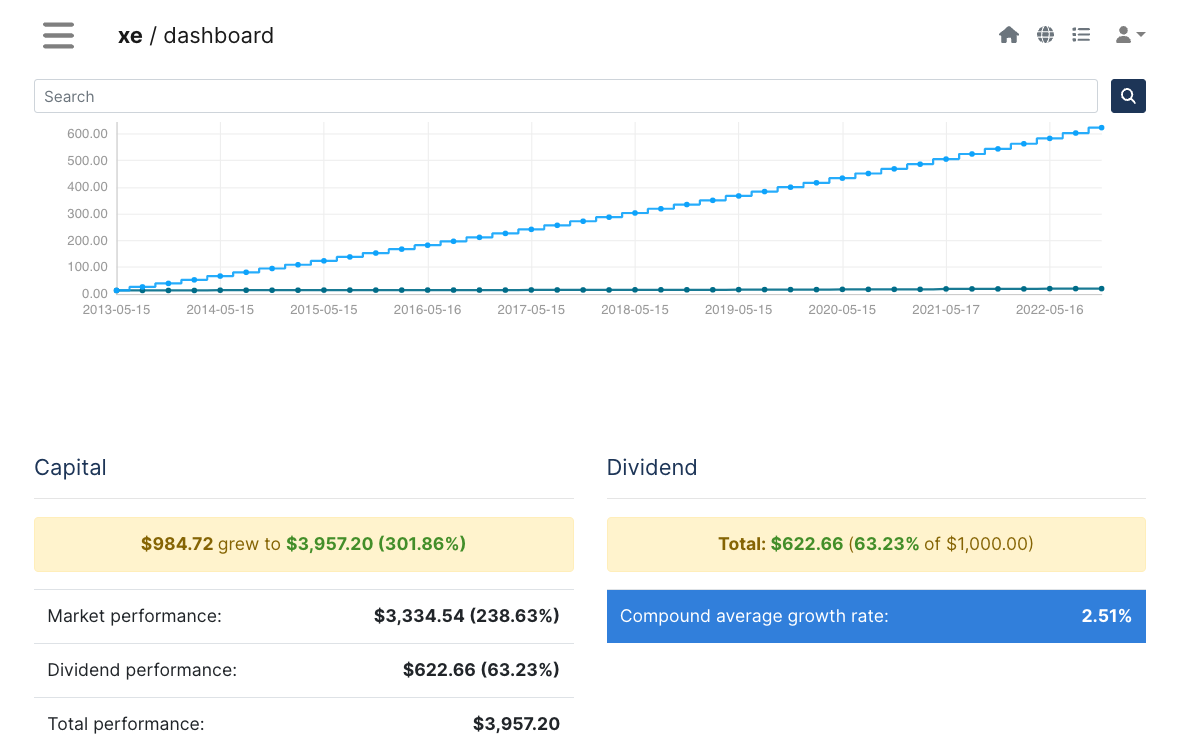

Performance Analysis

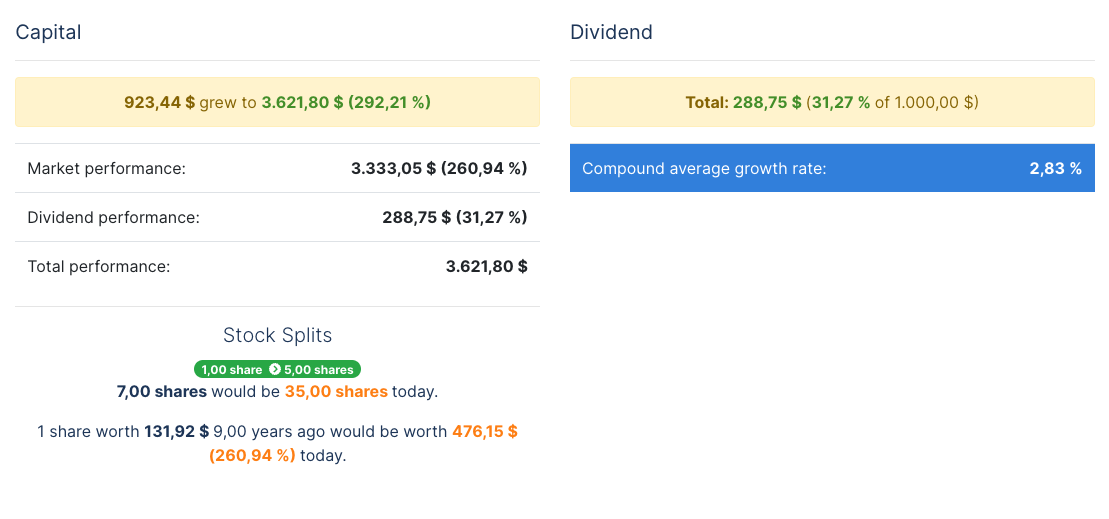

Long Term Backtest

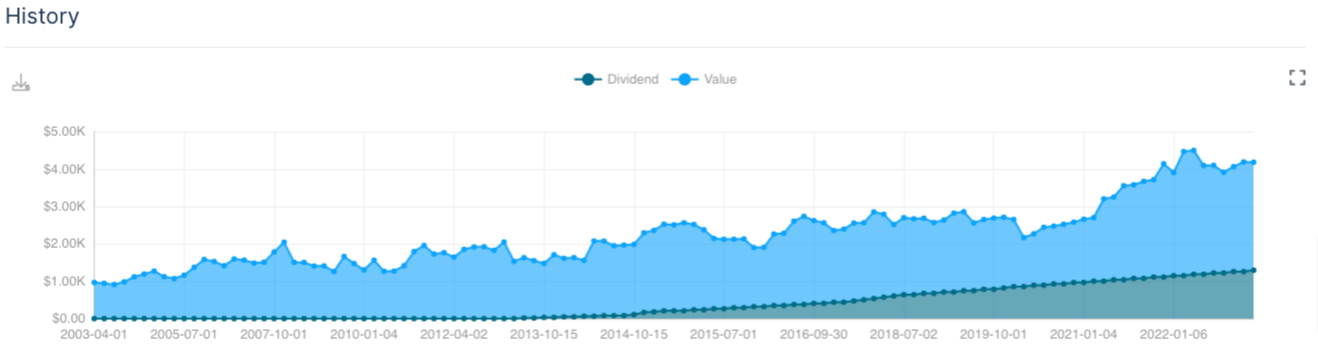

The performance charts show the share of price development and dividend payments in profit or loss over a long investment period.

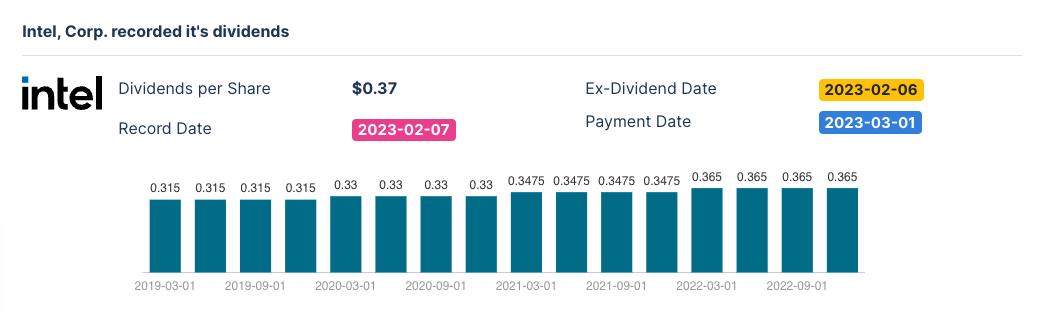

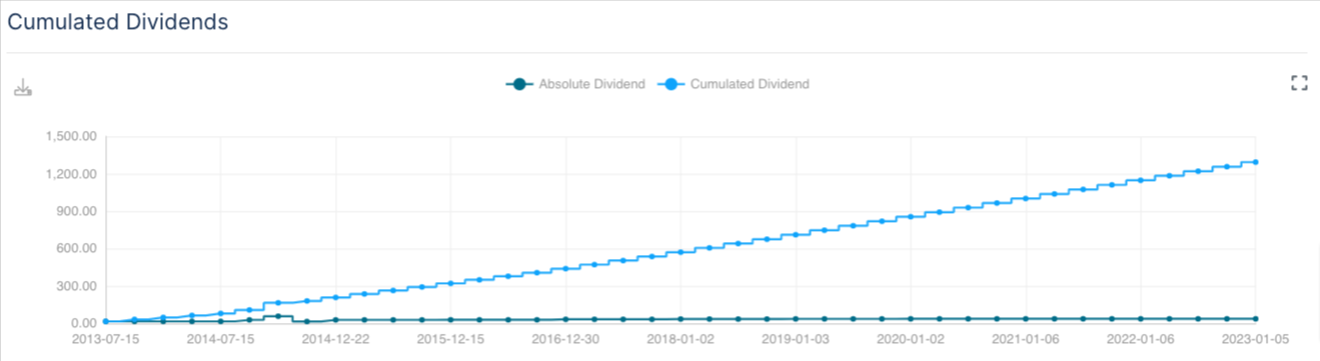

Dividends

Dividend growth rates and the return on investment are important factors, in addition to the profit payout ratio, which we map visually.

Splits

We calculate how the share price would have developed without splits.

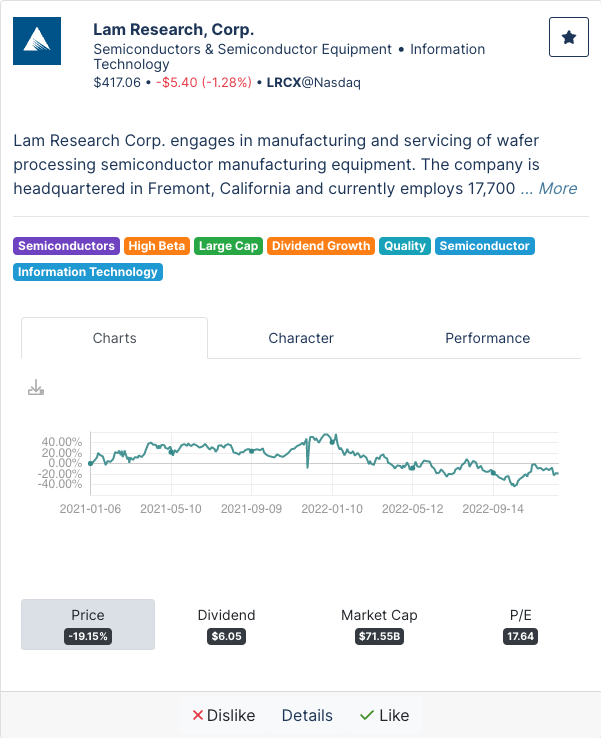

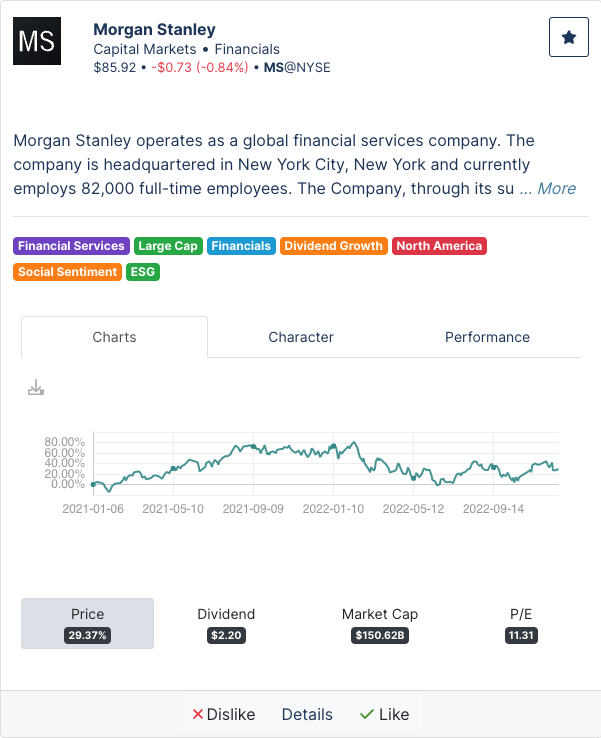

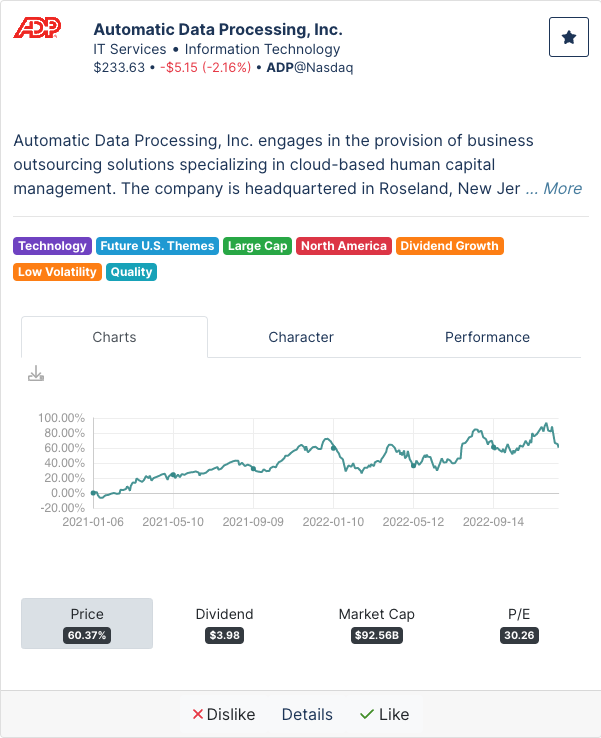

Discovery

Discover new companies

We analyze the holdings held by professional investors to present companies that might interest you.

Compare companies

Discovery is designed to quickly compare company metrics.

Pricing

- AI Feed

- Smart Tags

- Fundamental Ratios

- Knowledge-Graph

- Discovery

- Financial Reports

- AI Feed

- Smart Tags

- Fundamental Ratios

- Knowledge-Graph

- Discovery

- Financial Reports

- 24/7 Support

- Invoice to your company

- Like commercial

- Individual Solutions

- White-Label Solution

- Personal Support

Contact

Contact

We appreciate your feedback.